President Joe Biden's White House published a statement of administrative policy, stating that the Administration has expressed its willingness to collaborate with Congress to establish a comprehensive and balanced regulatory framework for digital assets. This framework aims to promote the responsible development of digital assets and payment innovations while reinforcing the United States' leadership in the global financial system. However, the Administration has criticized H.R. 4763 (FIT21) in its current form.

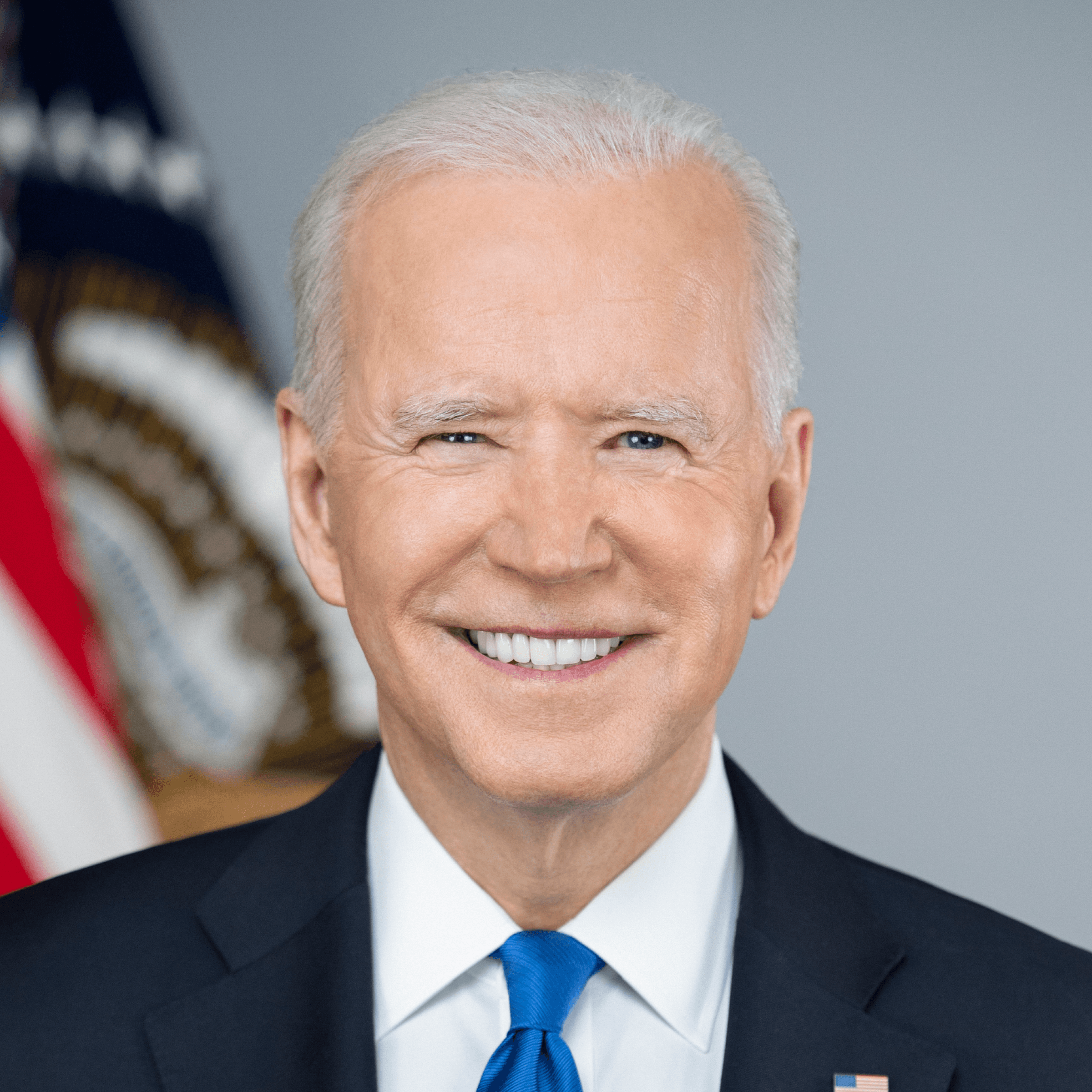

Joe Biden

Democrat President

20 January, 2021 - 19 January, 2025

Notable statements

Regulator’s choice not to challenge Grayscale Investments’ Court of Appeals win among the bullish signs for eventual spot bitcoin ETF approval.

“The SEC's reliance on an enforcement-only approach in the absence of clear rules for the digital asset industry is hurting America’s economic competitiveness and companies like Coinbase that have a demonstrated commitment to compliance,” said Paul Grewal, Coinbase’s chief legal officer and general counsel, who said the solution will be action from Congress. “In the meantime, we’ll continue to operate our business as usual.”

I’m also proposed closing over a dozen special interest tax loopholes for Big Oil, crypto traders, hedge fund billionaires — saving taxpayers billions of dollars.

Cryptominers’ high energy consumption has negative spillovers on the environment, quality of life, and electricity grids where these firms locate across the country (OSTP 2022). Pollution from electricity generation falls disproportionately on low-income neighborhoods and communities of color (Thind et al. 2019). Cryptominers’ intensive and often volatile power consumption also can push up electricity prices for consumers and can increase risks for local electrical grids—straining equipment, causing service interruptions and safety hazards (Chelan County 2018). Yet because cryptomining is geographically mobile and the stability of the business model remains unclear, local utilities also face financial risks if they invest in upgrading capacity that may not be needed if mining activity ceases or moves away.

The environmental impacts of cryptomining exist even when miners use existing clean power. For example, in the case of communities with hydropower where cryptomining operations are often located, increased electricity consumption by cryptominers reduces the amount of clean power available for other uses, raising prices and increasing overall reliance on dirtier sources of electricity.

Alongside these known costs and risks, cryptomining does not generate the local and national economic benefits typically associated with businesses using similar amounts of electricity.

We must reinforce United States leadership in the global financial system and in technological and economic competitiveness, including through the responsible development of payment innovations and digital assets.